If you’re on Medicare (or about to enroll), make sure you know what is coming to Medicare for 2026. Each year Medicare adjusts what you pay for premiums and coverage, but other changes could affect your overall costs. These include premium and deductible increases, changes to the Part D cap on maximum out-of-pocket costs, new Medicare-negotiated drug prices, prior authorization changes, and the elimination of the Value-Based Insurance Design (VBID) model. Some of these changes may affect everyone!

Below, we’ll break down what’s changing so you can be prepared.

1. 2026 Cost Changes for Medicare Part A and Part B

The Part B Premium and deductible are going up

For 2026, the standard Medicare Part B premium is projected to increase to $202.90 per month. This is up from $185 in 2025. That’s an increase of roughly 10%. If you have an Income Related Monthly Adjustment Amount, then your premium may be higher depending on your income bracket. If you are low income, then you may qualify for assistance paying for your Part B premium.

The Part B deductible is also increasing from $257 in 2025 to $283 in 2026. Once you meet that deductible, you still pay 20% of the for most Part B-covered services. If you have a Medicare Advantage plan, then most plans do not have a deductible so this change may not affect you.

Part A Hospital deductible and coinsurance are higher too

Most people pay $0 for the Part A premium if they have enough work credits. or a spouse worked and paid taxes for 10 years. But the hospital deductible and coinsurance amounts are increasing in 2026.

Part A inpatient hospital deductible will increase to $1,736 per benefit period, up from $1,676 in 2025. This deductible covers the first 60 inpatient days in the hospital. After this, the copay for days 61-90 is going up to $434 per day. The Part A lifetime reserve days are increasing to $868 per day.

If you have a Medigap or a Medicare Advantage plan, then your deductible and copays are likely lower than this. Be sure to compare all plans in your area to get hospital coverage at a price you can afford.

2. 2026 Part D Deductible and Maximum Out-of-Pocket Cost

2025 had the biggest impact on prescription costs by eliminating the coverage gap and reducing the maximum out-of-pocket costs for drugs. This will continue in 2026, but with the below increases to both the maximum out-of-pocket cap and the deductible.

Higher Part D deductible

In 2026, the maximum Part D deductible increases to $615, up from $590 in 2025. This is the maximum deductible set by Medicare, but actual deductibles can vary by plan. Plans can choose a lower deductible for their plan design, but they cannot charge more than $615 for the deductible. It is important to work with an independent agent to help you shop low cost coverage for your specific prescriptions.

New annual out-of-pocket cap of $2,100

The Inflation Reduction Act capped Part D drug spending at $2,000 starting in 2025. In 2026, this cap will rise to $2,100. Once you hit $2,100 on covered Part D drugs in 2026, you won’t pay any cost sharing for covered drugs for the rest of the year. This cap includes the deductible and copays at the pharmacy, but it does not include your Part D monthly premium. It also excludes any drugs that your plan’s formulary doesn’t cover, as well as drugs a doctor administers in an office or facility.

The Prescription Payment Plan (M3P) will continue for 2026. If you have high-cost drugs, this lets you spread your out-of-pocket Part D costs over the year. This is ideal for people with high costs in the beginning of the year. If you are already on the payment plan, this plan will automatically renew if you are on the same plan. However, if you change plans then you will need to contact your new plan to opt-in again in January.

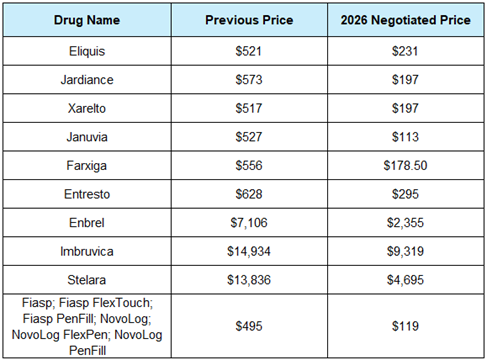

3. Lower Medicare-Negotiated Drug Prices

2026 is the first year that Medicare beneficiaries will see the impact of Medicare drug price negotiations. Due to the Inflation Reduction Act, Medicare has negotiated the prices of certain high-cost prescriptions. They started with an initial group of 10 high-cost drugs, which will take effect January 1, 2026.

These drugs were chosen as the first negotiations because:

- Among the highest cost in Medicare Part D

- Widely used by Medicare beneficiaries

See the list of negotiated drugs below.

It’s still important to compare Part D and Medicare Advantage plans each year. The formularies and tiers may change from plan to plan in response to the new pricing rules. The base price of these drugs may be lower, but not all plans cover them at the same copay level. The same drug can be more or less expensive from one plan to another! Always seek the help of a licensed agent to make sure your prescriptions are covered at the lowest price every year.

4. Medicare Begins Prior Authorization Tests in 6 States

Until now, prior authorization has been minimal for Original Medicare. This has been one reason why some opt for a Medicare Supplement instead of a Medicare Advantage plan. This is changing for some states in 2026.

The WISeR (Wasteful and Inappropriate Service Reduction) Model will run from January 1, 2026 through 2031 in six states. These states include New Jersey, Ohio, Oklahoma, Texas, Arizona, and Washington. CMS will test prior authorization or enhanced review for more medical services that are vulnerable to overuse or improper billing. Early efforts will focus on procedures like some outpatient surgeries, nerve stimulators, epidural injections, incontinence control devices, and diagnosis and treatment of impotence, to name a few.

What this means for you (if you live in NJ, OH, OK, TX, AZ, or WA):

- Your doctor may need to obtain prior authorization for some procedures that previously did not require it under Original Medicare.

- If Medicare denies a prior authorization request, you’ll have appeal rights, but it could slow down access to certain services.

- Keep an eye on communications from Medicare and your providers. This is still a test, and details may evolve over the 6-year model period.

5. Elimination of the Value-Based Insurance Design (VBID) Model

The Medicare Advantage Value-Based Insurance Design (VBID) Model was created to allow MA plans to offer more flexible, tailored benefits. This included monthly credit to pay for healthy foods or home utility bills. Starting in 2026, the VBID Model is ending. Some beneficiaries may see a reduction in some of their Medicare Advantage Benefits. The Healthy Foods allowance will no longer be guaranteed to everyone who is enrolled in a plan with this benefit. But not all. People who previously qualified for the healthy food benefit may still qualify in 2026 under the Special Supplemental Benefits for the Chronically Ill (SSBCI). You will now need to demonstrate that you have a qualifying chronic condition. Luckily, the list of chronic conditions is large! Be sure to check with an agent to see if will continue to receive this benefit!

How to Prepare for the Medicare Changes in 2026

Here are some practical steps to take as you plan for the 2026 Changes. Check your budget for 2026 to consider rising premiums and deductibles. If your Medicare Supplement payments are getting too high, then take time to compare it to Medicare Advantage plans to see if it is a good fit. Also, review your drug list and plan changes to make sure you have the coverage you need. If you need to enroll in the Prescription Payment Plan, then be sure to contact your plan carrier in January. If you live in one of the 6 prior-authorization test states, talk to your providers to make sure you are getting prior authorization when needed.

Need personal help with your Medicare? Contact one of our local, licensed agents to help you with your questions and to explore your options.