Welcome to the less than thrilling journey into Medicare Advantage plans, where the options are as plentiful as Ben and Jerry’s ice cream and as complex as trying to map out the Marvel timelines! But for many seniors, it is an unavoidable task necessary to find the right coverage. Does this mean you have to compare all Medicare Advantage Plans across all carriers? The short answer is, ABSOLUTELY. Every plan has different combinations of coverage, formularies, and provider networks. Don’t get stuck trying to fit your medical and financial situation into the plan your neighbor or sister recommended. If the shoe doesn’t fit, don’t wear it!

We know that searching for plans is like trying to solve a 10,000 piece puzzle without the picture. But fear not! We’re here to simplify the process and empower you to make informed decisions. In this guide, we’ll delve into why comparing all Medicare Advantage plans is essential and how you can make sure you have the help you need to compare all major carriers and plans.

Why Compare All Medicare Advantage Plans?

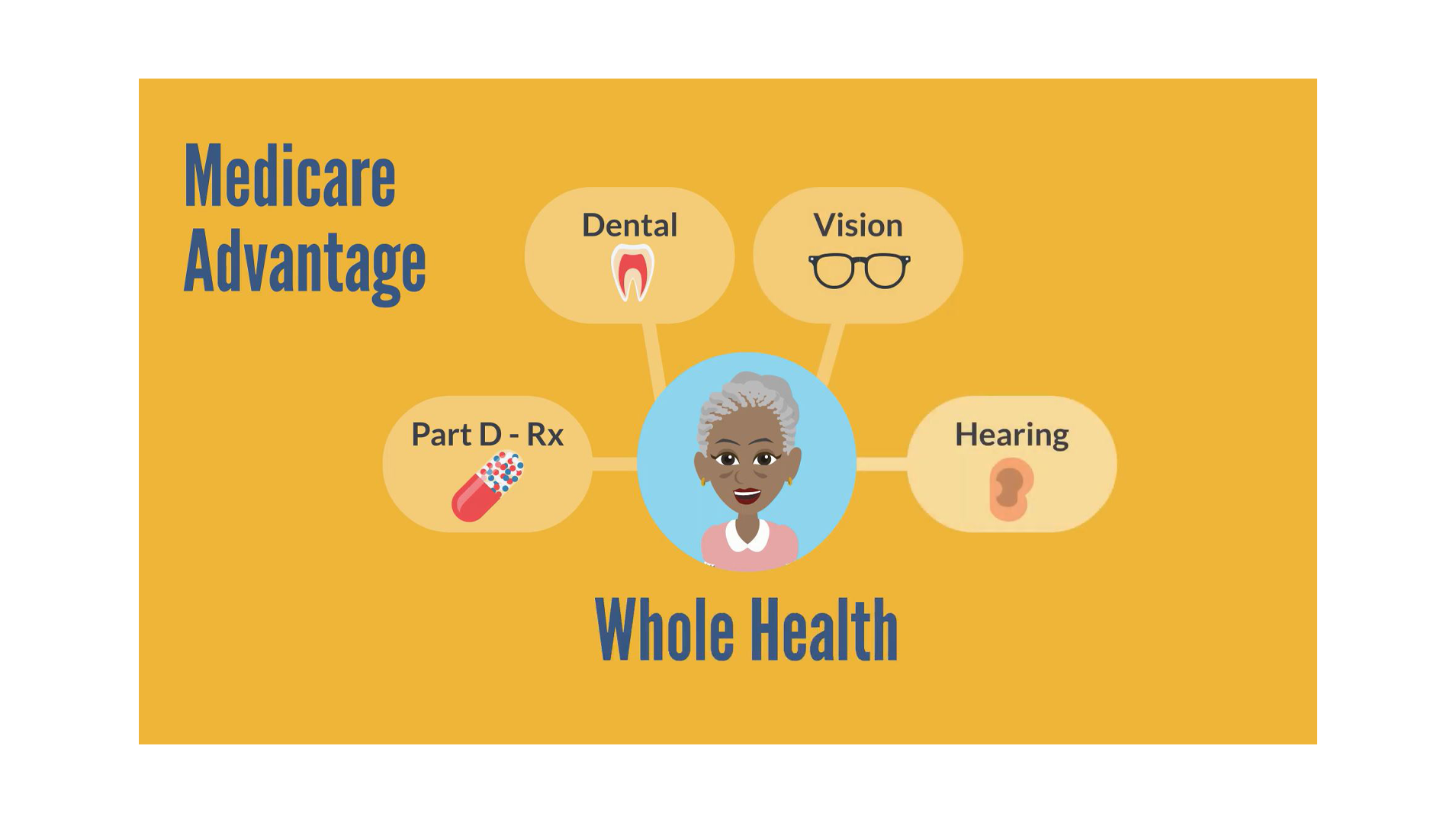

- Personalized Coverage: Everyone’s healthcare needs and what they want out of their plan are unique. By comparing all available Medicare Advantage plans, you can identify the one that offers the best coverage for your specific medical requirements, including flexibility, prescription drugs, vision, dental, and more.

- Cost Savings: Medicare Advantage plans vary in terms of premiums, deductibles, and out-of-pocket expenses. Some have lower doctor co-pays, but higher hospital co-pays. Others have lower maximum out-of-pocket costs in case of catastrophic events, but may have less dental or vision coverage. Prescription drug formularies are all different as well. Your prescriptions on one plan can be considerably less expensive than on a different plan. Thorough comparisons can uncover cost-effective options that align with your budget and needs without compromising on coverage!

- Provider Networks: Make sure you can continue to see all your doctors! Like group or employer plans, Medicare Advantage plans have provider networks. Different plans and carriers can have different doctors in their network. Comparing plans ensures that your preferred doctors, specialists, and hospitals are included in the network. It also lets you compare PPO and HMO plans to find your preferred level of flexibility.

- Additional Benefits: Medicare Advantage plans often offer supplemental benefits such as dental, vision, over-the-counter, gym memberships, telehealth services, and wellness programs. By comparing plans, you can identify those plans that provide more valuable additional perks to enhance your overall healthcare experience.

- Customer experience: Medicare assigns star ratings to each Advantage plan based on factors such as quality of care, customer satisfaction, and member experience. Comparing plans lets you compare start ratings and see which plans rate higher.

- Travel benefit: If you are a snowbird and travel to other states for a few months out of the year, then you should pay attention to plans with a travel benefit. This allows you to use the plan’s network in other states. Emergency travel while vacationing abroad can vary as well. Although, Medicare and plan options are limiting when traveling outside of the U.S. Learn more about Medicare and Travel Insurance: Why You Need Emergency Medical Coverage Outside of the Country

How to Compare All Medicare Advantage Plans?

Let’s revisit that 10,000 piece puzzle. We know it is not practical or easy for people to find and compare all plans on their own. It is even more confusing to make sure your prescriptions and providers are covered at the lowest cost. Any mistake can cost you! Here are your options for comparing plans.

Use an Independent Agent

Due to the overload of options, we repeatedly voice to anyone who will listen to always use an independent agent. We do not recommend using an agent employed by a single insurance provider. You can’t get unbiased help from someone who can only enroll you in one carrier’s plans. As independent agents, we contract with all major carriers. These carriers all pay agents the exact same amount so there is no incentive for an independent agent to steer you to a plan that doesn’t work for you. This is set by Medicare to avoid bias. You will know you are receiving unbiased support no matter which plan or carrier you choose. Not all independent agents contract with all major carriers, so be sure to vet your agent and ask if they are.

Meet our agents! We are contracted with all major carriers to offer unbiased help.

Independent agents are most suitable to help because they have the tools and platforms that let them compare all plans. These platforms compare carriers, plans benefits, prescription costs, and provider networks all at once. This means they are doing the hard work for you! You should never be charged for this service. We always offer NO COST service, plan comparison, and general Medicare help to everyone.

See more on the Benefits of Using an Independent Agent for Medicare

Compare on Your Own

We know some people prefer to do things on their own, or at least start the process to get an idea of plans. If you are tech and insurance savvy, and ready to jump down the Medicare Advantage rabbit hole, you can start your search using our online plan finder HERE. You can compare all major plans in your area, as well as search provider and prescription formularies. If you choose this route, we recommend following up with an agent to double check your doctors and prescriptions are covered. Some formularies and provider networks are complex, and one mistake can make a big difference.

Consider These When Choosing Medicare Coverage

Want more help navigating Medicare?

don’t do it alone! We are here to make it easier!

Conclusion:

We know comparing all Medicare Advantage plans does not top your list of things you want to do on any given day. But choosing the right plan for you does require careful consideration and comparison of all available options. By evaluating factors such as coverage, costs, provider networks, and additional benefits, you can select a plan that best meets your needs. There is not one plan we can call The Best Medicare Advantage plan… there is only The Best Medicare Advantage plan for your specific needs.