Medicare Advantage plans have grown in popularity and availability. Some metropolitan areas can have as many as 50-70 different options. This can make it difficult to compare and find the perfect plan. A question we get regularly from beneficiaries is, “What is the best Medicare Advantage plan?” The answer to this question is complicated and depends on your individual needs, health, budget, and benefits that are important to you. Due to the complexity of plans, as well as individual needs and preferences, we always reframe this question: What is the best Medicare Advantage plan for you?

We answer this question by breaking down the important factors you should consider when comparing plans.

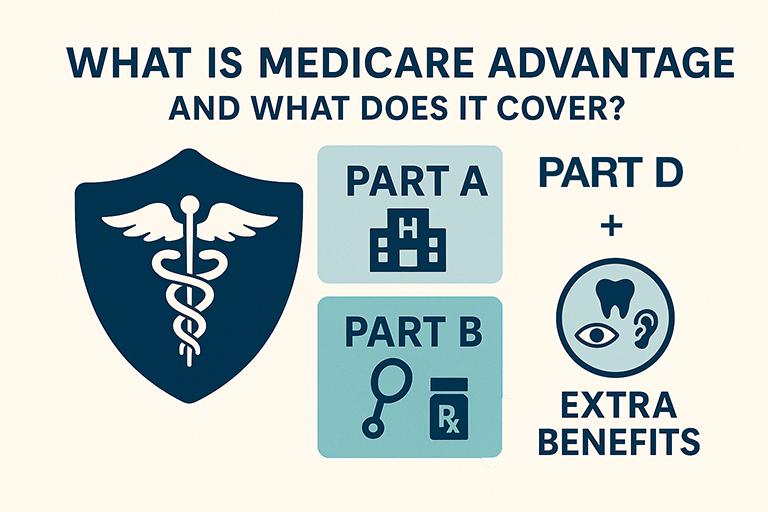

What is Medicare Advantage?

Medicare Advantage plans provide all your Original Medicare benefits in a managed plan offered by private insurance companies. These plans are a part of Medicare, called Part C, and they must cover at least what Original Medicare covers. But most Medicare Advantage plans also include Part D and cover extra benefits. These extra benefits can include dental, vision, hearing aids, over-the-counter allowance, fitness memberships, and a Part B giveback. Medicare Advantage plans can also include more coverage for some items than Original Medicare, like additional chiropractor and acupuncture coverage. They can also include lower maximum out-of-pocket spending caps, copays, coinsurance and deductibles.

What to Consider when finding the Best Medicare Advantage Plan for you?

Monthly Premium

Monthly premium cost is a big factor for most people. This is the amount you must pay each month whether you use your plan or not. If you are healthy, then paying a high premium for coverage you don’t use may not be the best for you. However, if you have more frequent health needs, then your situation may differ. If a higher premium means lower out-of-pocket costs when seeking care, then this may be a benefit if you use your plan a lot. So the best Medicare Advantage plan will have a premium that makes sense for you.

Out-of-Pocket Costs

Your out-of-pocket costs on a Medicare Advantage plan includes your monthly premium, deductibles, copays, coinsurance, and prescription drug costs at the pharmacy. You should determine which medical services you typically use in any given year. These costs should be considered when deciding on the best Medicare Advantage plan for you.

Maximum Out-of-Pocket Spending

The maximum out-of-pocket expense on a Medicare Advantage plan is the most you will pay for Medicare covered expenses in any given year. After you reach this maximum, the plan pays 100% of costs. This amount is important to consider when shopping for plans. If you have a lot of health-related issues, then you may want to consider a lower maximum out-of-pocket plan to keep yearly costs down. If you are relatively healthy, then you may get away with a higher maximum out-of-pocket depending on your comfort level and savings. In the event of a catastrophic health incident, how much could you comfortably afford to pay?

Prescription Drug Coverage and Costs

Each Medicare Advantage plan has a different formulary for prescriptions. The best Medicare Advantage plan should cover all your prescriptions at the lowest out-of-pocket cost. This means you should be searching the formulary for all Medicare Advantage plans in your area. This can be time consuming, so we recommend you check out our article on How to Easily Compare All Medicare Advantage Plans to Find the Best Plan For You or contact our licensed agents to do it for you.

Provider Coverage

The same goes for your doctors! Each plan has a different network of providers. If a plan does not allow you to see your doctors in network, then it may not be the best Medicare Advantage plan for you. Never join a plan without first checking the provider networks. We have seen many Medicare beneficiaries get enrolled into a plan that did not have their doctors in network. If you have a lot of doctors or need to visit a lot of specialists, then a plan that has a larger network may be better for you. This can vary by area. Our licensed agents are contracted with all major carriers so we can search all your doctors against all the networks at once! If you do want the option to go out of network, then a PPO Medicare Advantage plan might be best for you.

Extra Benefits

One of the big draws to Medicare Advantage plans are the extra benefits. Most plans include extra benefits, such as dental, vision, hearing aids, over-the-counter allowance, fitness memberships, or Part B giveback. The amount and robustness of extra benefits do vary by plan. The best plan will include the benefits that are most important to you. For example, do you need dentures in the coming year? Then a plan with a much higher dental limit that has first dollar coverage may be better for you than one that gives a fitness membership.

Star Ratings

If the best Medicare Advantage plan means excellent healthcare and customer service, then you would want to look at the star ratings. Every year, the Centers for Medicare and Medicaid Services (CMS) rates each Medicare Advantage plan based on many quality and performance categories. These are based on factors that include member feedback, plan complaints, data from providers and hospitals, and the number of members who left or stayed on the plan. CMS then issues the below 3 ratings:

- Overall Star Rating

- Health Services Rating

- Drug Services Rating

The more stars, the higher the rating. Did you know, if you live in an area with a 5 Star plan you can use a Special Election Period to enroll in that plan outside of the Annual Election Period?

How to pick the Best Medicare Advantage plan for you?

As you can see, there are a lot of factors that go into deciding on the best Medicare Advantage plan for your needs. Plans also vary in coverage and benefits, making the task more difficult. This means finding the perfect plan involves determining your needs and comparing plans in your area.

Step 1: First, you should make a list of your doctors, prescriptions, health needs, financial needs, and benefits that are important to you. This will ensure that you are considering everything when it is time to compare plans. Yes, you need to compare them all to make sure you have what you need! But the process is much easier than it sounds.

Step 2: Contact a licensed independent agent! Independent agents that offer all major carriers can help by searching all Medicare Advantage plans at once. One big mistake we see many beneficiaries make is going directly to one carrier. That one carrier is only considering their company plans for your needs. You could be missing out on the best plan for you if it is with another company.

We love helping Medicare beneficiaries and their families get what they need! Reach out to schedule an appointment with one of our unbiased, licensed agents for free Medicare help!