Applying for Medicare can be easy when you use the correct Medicare enrollment form at the right time. Using the wrong form, or even the wrong enrollment method, can have consequences. This guide breaks down the important Medicare enrollment forms and shows you exactly when and why to use each form.

Understanding the Different Medicare Enrollment Forms

It’s important to understand the various Medicare forms and when to use them. Completing and submitting the correct Medicare form using the proper method can make signing up for Medicare much easier. If you use the wrong form—or send in the right one at the wrong time—you could face issues. These issues might include:

- Processing delays

- Gaps in coverage

- Late enrollment penalties

The method you use to submit your form is just as important as using the correct form. Some people can simply apply online, making processing quick and easy. But other people must submit their forms to Social Security using fax, mail, or in person. We will cover each Medicare enrollment scenario and the forms to use below.

Enrolling in Part A, with or without Part B: Medicare Enrollment Form CMS-18-F-5

When first enrolling in Part A, you will use CMS-18-F-5: Application for Part A (Hospital Insurance). This is available as a paper application, or you can complete it online using your My Social Security account. You can also use it to enroll in Part B if done simultaneously with Part A. If you are already enrolled in Part A and want to add Part B, then you will use a different form covered later in this blog.

You would also use CMS-15-F-5 to enroll in Premium Part A if you do not have enough work credits to qualify for premium-free Part A.

You can use this Medicare enrollment form to enroll during the following enrollment periods:

- Your Initial Enrollment Period – The 7-month period around your 65th birthday, when you are first eligible for Medicare.

- The General Enrollment Period – January 1st to March 31st if you missed your Initial Enrollment Period.

- During a Special Enrollment Period if you are leaving a creditable employer group plan and delayed Part A.

What if you are already receiving Social Security benefits when you turn 65? If you are already receiving Social Security benefits when you turn 65, then Medicare will AUTOMATICALLY enroll you in Part A and Part B. You will not need to use this form to enroll.

An automatic Medicare enrollment could pose a problem if you are still working and want to maintain coverage under your employer plan. If Medicare automatically enrolls you but you want to keep your employer plan, you must decline Part B.. The letter you receive from Medicare notifying you of your enrollment will list instructions on how to decline Part B.

If you need help deciding between your group plan and Medicare, read our blog on Choosing Between Medicare and Employer Plan: What You Need to Know

Enrolling in Medicare Part B only: Medicare Enrollment Form CMS-40B

Many people will get Part A when they first turn 65 because it is premium-free for most people. Then, later they will need to enroll in Part B only. If you need to enroll in Part B, then you will use Form CMS-40B: Application for Enrollment in Medicare part B.

Form CMS-40B is used for any of the reasons below:

- If you kept working past 65 and maintained creditable group coverage and are now eligible for a Special Enrollment Period (you also need Form CMS-L564 below)

- If you’re still in your 7-month Initial Enrollment Period and initially refused Part B or did not sign up when you applied for Medicare, but now want Part B.

- If you want to sign up for Part B during the General Enrollment Period (GEP) from January 1 – March 31 each year.

- If you’re in your Initial Enrollment Period (IEP) and live in Puerto Rico. You must sign up for Part B using this form.

This form is available to complete both online or as a paper application that you can fill out, sign and return to your local Social Security office. Online is usually the fastest option. The online option for this form looks like an Adobe fillable PDF form, but it allows you to digitally sign using Adobe Sign.

Need help Choosing Between Medicare and Employer Plan: What You Need to Know?

If you are using form CMS-40B to enroll in Part B after leaving an employer group plan, then you will have to include the next form below to provide proof of your creditable coverage.

Medicare Form CMS-L564: Request for Employment Information

If you are applying Part B after you delayed it to stay on an employer plan, then you will need to provide proof of creditable coverage. This proof gives you a Special Enrollment Period to enroll if you missed your Initial Enrollment Period. It also prevents Medicare from issuing a lifetime Part B penalty.

You employer needs to complete and sign Form CMS-L564. Once completed, you will submit this form with your CMS-40B application. Double-check that your employer completed and signed the application correctly to avoid delays!

See instructions on how to accurately complete the CMS-L564 in our previous blog HERE.

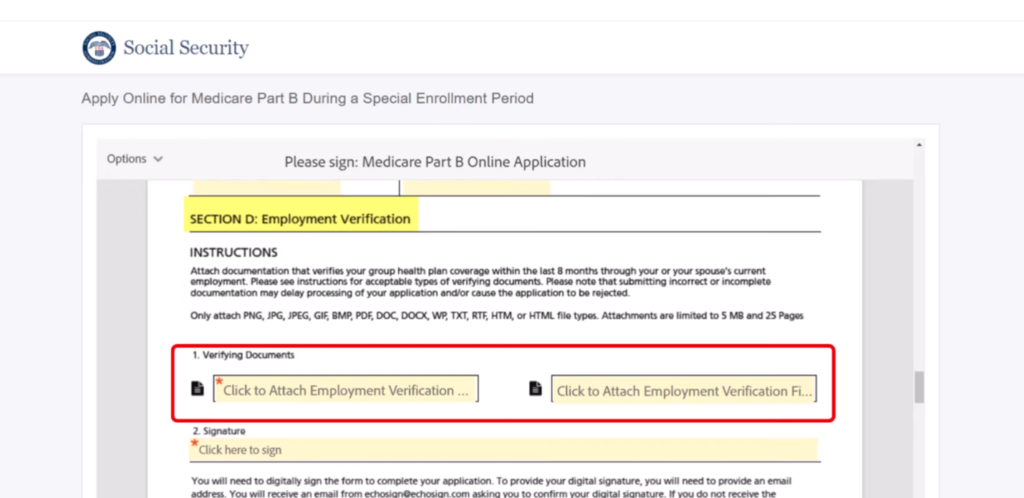

If you are submitting your CMS-40B application online, then you can upload a scanned copy of the signed CMS-L564 directly to the online version of the CMS-40B. Remember, the online version of the CMS-40B looks like a fillable PDF, but there is a section that allows you to upload before you sign and submit the document. See example of where to upload it below. If you miss uploading the form before you sign the online version of the CMS-40B, then you can no longer submit the CMS-L564 online. You will then need to send it into the Social Security office near you.

Here is a screenshot showing where you upload CMS-L564 to the online CMS-40B form. It is directly before you digitally sign.

Enrolling in Medicare Part B only but you are NOT entitled to Social Security/Railroad Retirement Board benefits

If you do not have enough work credits to qualify for Social Security benefits or Railroad Retirement Board benefits, then you would have to pay a premium for Part A Hospital coverage. Since this premium is costly, many people do not wish to enroll in Part A. However, some still want to enroll in Part B Medical coverage since the premium is lower.

If you want to enroll in Part B but not Premium Part A, then you would use Medicare form CMS-4040: Request for Enrollment in Supplementary Medical Insurance.

Enrolling in Part A or Part B due to Exceptional Conditions: Medicare enrollment form CMS-10797

If you had an exceptional condition that prevented you from enrolling in Part A or Part B during a valid enrollment period, then you may be able to sign up without a late enrollment period. Valid enrollment periods include whether you missed your Initial Enrollment Period, the General Enrollment Period, or a Special Enrollment Period that you were previously eligible for.

If you qualify for exceptional conditions, then you would need to use form CMS-10797: Application for Medicare Part A and Part B – Special Enrollment Period (Exceptional Conditions).

Qualifying Exceptional Conditions for form CMS-10797 include:

- Individuals impacted by an emergency or natural disaster declared by a federal, state, or local government entity.

- Individuals who received misinformation provided by an employer, group health plan, or agent/broker of a health plan.

- Individuals that have lost or will lose Medicaid coverage.

- Formerly incarcerated individuals.

You will need to provide proof of the exceptional condition along with the application form. This form cannot be completed online. You can submit it to your local Social Security office using fax, mail, or an in-person appointment.

Enrolling in Medicare based on End-Stage Renal Disease: Medicare Enrollment Form CMS-43

Individuals with End-Stage Renal Disease (ESRD) can qualify for Medicare at any age if they meet the qualifications. You can enroll in both premium-free Part A and Part B. If you are enrolling in Medicare due to ESRD you will need to use CMS-43: Application for Hospital Insurance Benefits for Individuals with ESRD. You can enroll in Part A only, or Part A and Part B.

How we can help you avoid enrollment processing issues

As you can see, Medicare enrollment can be complex depending on your situation. Any mishap can cause processing delays. Recent decreases to the Social Security workforce and changes to phone appointments can further increase delays. Social Security currently has long phone wait times, and in-person appointments take time to schedule. The best way to ensure you are completing the process correctly is to use a local agent like our team here at The Medicare Navigators.

We can help you with the enrollment process by helping you obtain the correct Medicare enrollment form, reviewing your enrollment forms for any mistakes, show you how to create a My Social Security account for quicker online access, locate your nearby Social Security office, and we can even fax your enrollment forms for you if you don’t have access to a fax. Medicare does accept faxes, but they do not accept emailed documents.

Please reach out to our local, licensed agents for enrollment help. We offer FREE ASSISTANCE to get you through the entire Medicare process!