The Extra Help/Low Income Subsidy can reduce out-of-pocket prescription drug costs for low-income beneficiaries. Medicare costs can add up! Even with Medicare coverage, there are a myriad of potential expenses including premiums, co-pays, co-insurance, and prescription drug costs. This means that some people with low, fixed income may go without care or needed medication.

Finding ways to save on Prescriptions can make a difference in health choices.

In this article we will cover the ins and outs of the Medicare Part D Low-income subsidy program so you will know:

What is Extra Help and Who Qualifies?

Also known as Low-income Subsidy (LIS), Extra Help is a federal program that helps low-income Medicare beneficiaries pay for out-of-pocket costs associated with Part D prescription drug coverage.

1. What you will pay with Extra Help

Extra Help will help pay for monthly premiums, annual deductibles, and co-payments related to the Part D prescription drugs. The assistance from the program is estimated to be worth about $2,100 per year.

Here is the breakdown of what you will pay if you receive Extra Help in 2025:

- Plan Premium: $0

- Plan Deductible: $0

- Generic Prescription Drug Copay: Up to $5.10

- Brand-name Prescription Drug Copay: Up to $12.65

- No Part D Penalty

If your total drug costs for the year reaches $2,100, you will pay $0 for each covered drug.

2. Qualifying for Extra Help

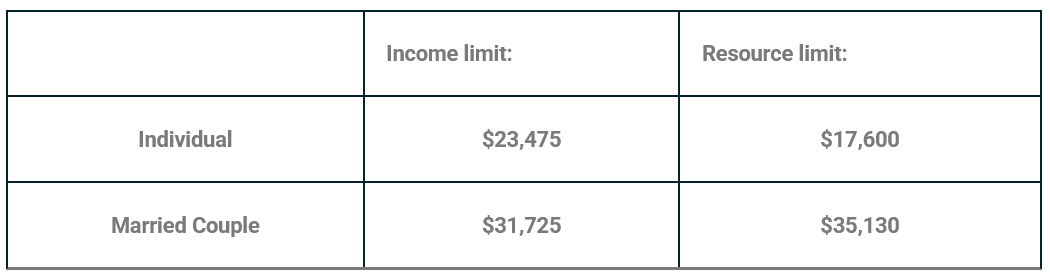

To qualify for Extra Help, a person must be receiving Medicare, have limited resources and income, and reside in one of the 50 States or the District of Columbia. The Extra Help income limits chart below lists the max income and resources you can have to qualify.

2025 EXTRA HELP INCOME LIMITS CHART

This LIS chart shows the income limits for most states. See the Extra Help limits for Hawaii and Alaska at the end of this blog in our FAQs section.

Want to Schedule a Part D Plan Review?

see if you are paying too much for your prescriptions!

How to apply for Extra Help?

You apply for for Extra Help through Social Security or your state’s department of economic security (Medicaid) office. The quickest way to apply is online through the Social Security website here. You can also call Social Security at 1-800-772-1213 to apply by phone, request a paper application mailed, or make an appointment at the local Social Security office.

Social Security can take approximately 3 weeks to process and make a determination on your application.

Disclosing Income on the Application

Not all sources of income needs to be included with your application. Below is a list of income that needs to be included, as well as sources of income that can be excluded.

The Following income needs to be included on your application:

- Social Security Benefits, Railroad Retirement Benefits

- Pensions or annuities, including veteran’s pensions

- Wages (gross) or earnings from self-employed (net)

- Rental income (net)

The following sources can be excluded from income when applying:

- SNAP (Food Stamps) and LIHEAP (fuel assistance) benefits

- Housing or home energy assistance

- Assistance from others to pay your household expenses

- Work-related expenses for people who get Social Security benefits for a disability or blindness

Disclosing Resources on the Application

Similar with income limits, your assets cannot be over the specified limits to qualify for any level of LIS. Below is a list of resources that needs to be include and those that can be excluded.

The Following resources need to be included on your application:

- Financial institution accounts (e.g., checking, savings, CDs)

- Cash at home

- Stocks, bonds, savings bonds, mutual funds, individual retirement accounts (IRAs), 401(k) accounts

- Real estate (equity value) other than primary home

- Certain trusts that allow a person to revoke or have direct use of funds

The following resources can be excluded from your application:

- Home in which the applicant lives

- All vehicles (autos, trucks, motorcycles, boats, snowmobiles, etc.)

- Household goods/furnishings, and personal effects (e.g., jewelry)

- Cash surrender value of life insurance policies

- In-kind support (e.g., non-cash help such as shelter)

- Irrevocable burial trusts/burial contracts

After applying, Social Security will review the application and send a letter letting you know if you qualify. People who already have Medicaid do not need to apply for LIS and will automatically qualify and get a letter from CMS letting them know.

Extra Help Application Tip: When applying for LIS, you can opt to start the application process for the Medicare Savings Program (MSP) and the Social Security Administration will send the application data to the state Medicaid office. MSP helps reduce the out-of-pockets costs of Medicare Part A and Part B.

Do you need to renew your application annually?

Yes! Be sure to keep an eye on your mail! Your annual renewal reminder will come in the mail every year. If you do not receive one, this does not mean you do not have to renew.

Continued Eligibility Requirement

You must continue to meet eligibility requirements each year. If you do not complete your review, or if your review shows you no longer qualify, then it will end December 31st. Keep in mind, this does not cancel your Part D Prescription Drug plan.

If you originally qualified for Extra Help because you have Medicaid or a Medicare Savings Program (MSP) and you are still enrolled in one of these programs come the fall, then you will not have to do an annual review through Social Security. When you renew these programs the state will automatically inform Social Security that you are still enrolled.

Losing Extra Help Coverage

If you anticipate your Extra Help will end, then you should review the Part D Prescription Drug plan to determine your new out-of-pocket costs. It may be a good idea to compare to other Part D Prescription Drug plans at this time. If you lose coverage, you will get a Special Election Period to find a new plan. It is recommended to speak with a licensed agent to help you compare all plans in your area at once.

What are my enrollment options if I qualify for Extra help?

Qualifying for Extra Help allows you to enroll in or change plans outside of Medicare’s Annual Election Period (AEP). This special election period is for Part D Prescription Drug Plans and Medicare Advantage plans with Part D. If you qualify for LIS, you can make a change once each quarter during the first 3 quarters of the year, as well as once during AEP with an effective date of January 1st.

Aside from these quarterly changes, you can also add or change a plan if you have any change in your LIS status. This includes if you lose eligibility, gain eligibility, or if your eligibility level moves up or down the previous mentioned benefit levels.

Need help seeing if you qualify?

We regularly help beneficiaries with Extra Help questions and to see if they qualify. CONTACT US TODAY to speak with one of our Licensed Agent to get help.

Medicare Extra Help FAQs

How much can I make and still qualify for Extra Help?

In 2024, the new income limits for an individual to qualify for Extra Help is $22,590 per year and for a married couple is $30,660 per year.

Do I have to list my spouse’s income on my Extra Help application?

Yes, if you are married then your spouse’s income in required.

I live in Hawaii or Alaska, are the income limits the same?

No, Income limits are higher for people who live in Alaska and Hawaii. Visit the Medicare site on Extra Help to see limits.

I lost my Extra Help coverage. Can I switch plans now?

Yes. If you lost Extra Help benefits then you get a Special Election Period to find a new part D or MAPD plan.

[…] help pay for prescription drug costs. See more on Extra Help and how it works in our latest blog, What is Extra Help? Eligibility for MSP is generally re-determined each year and if your income increases or […]