If your modified adjusted gross income is above a certain amount, you may pay an Income-Related Monthly Adjustment Amount (IRMAA) for your Medicare Part B and Part D. You may be able to appeal your IRMAA in certain circumstances. We put together the following step-by-step guide to help you appeal the Income-Related Monthly Adjustment Amount for Medicare:

Step 1: Make sure you’re prepared

- Carefully review the IRMAA notice you received regarding the IRMAA determination. The notice will include the reason for the adjustment and the specific income information used in the calculation. You can see the current IRMAA brackets here: (Costs | Medicare)

- Pay attention to timeframes! The appeal needs to be filed within a specified timeframe – the notice will indicate that timeframe.

- Gather supporting documentation: You will need documentation to support your appeal. This can include tax returns, Social Security benefit statements, or proof of life-changing events.

- A few of the most common events are marriage, divorce, or no longer working.

- Choose the appropriate appeal form. The form you choose will depend on if you’re appealing your initial IRMAA determination, or requesting a new determination due to a life-changing event.

- Form SSA-561-U2 (Request for Reconsideration) is used if you want to appeal the initial determination of your IRMAA. This form is used to request a review and reconsideration of the decision.

- Form SSA-44 (Life-Changing Event) is used if you experienced a life-changing event that has caused a significant reduction in your income. This form allows you to request a new determination of your IRMAA based on your current income.

- Some examples of life-changing events include marriage, divorce, death of a spouse, work stoppage, reduction in work hours

Step 2: Complete your appeal form

When completing your appeal form be specific and provide supporting evidence! Provide a detailed explanation of the reasons for your appeal. Keep in mind: If you have a high income from a one-time event such as selling a home, selling investments (stocks or bonds), Roth IRA conversions, taking a required minimum distribution (RMD), or winning the lottery, and then your income decreases the following year, you may be unable to adjust your IRMAA fee. However, if you have a separate qualifying event at the same time, you can still appeal the IRMAA fee.

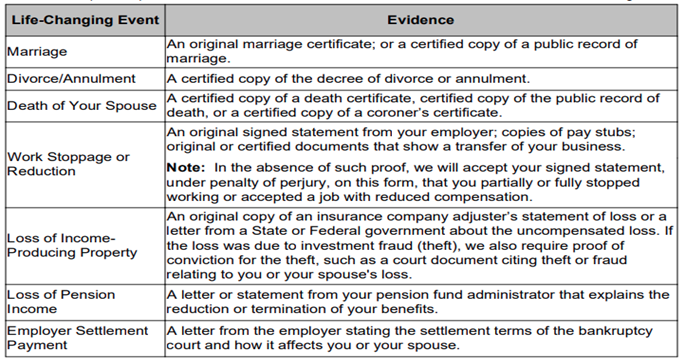

The chart below provides some examples of life-changing events that can be appealed, and the evidence needed to support it:

Step 3: Submit your appeal

Ensure that you follow the instructions for submission, which may include mailing the form or submitting it electronically. Keep track of all important dates and documents! Keep copies of all documents submitted for your records. Write down important dates, such as when you mailed the appeal or received confirmation of electronic submission.

Step 4: Wait for the decision

The Office of Medicare Hearings and Appeals (OMHA) will review your appeal and make a decision. This process may take several weeks or longer, so be patient. Once a decision is reached, carefully review the outcome. If your appeal is approved, any adjustments to the IRMAA will be made accordingly. You may qualify to get a refund or credit on the premiums you may have overpaid for due to the IRMAA fee.

Remember, appealing the IRMAA penalty is not an easy process, but it is worth the effort if you believe you qualify for a lower premium. Be patient and persistent, as navigating the appeals process can take time and require multiple steps. Seek assistance from professional resources.

Furthermore, stay informed about any changes in Medicare regulations and policies. Staying up-to-date can help you understand your rights, eligibility criteria, and any new avenues for appealing the IRMAA penalty.

If you still have questions on this process or have general Medicare questions, reach out to our friendly agents here!