There are so many decisions to make when you become eligible for Medicare. One big decision is which coverage option you need: Medicare Advantage or Medicare Supplements (also known as Medigap). In line with most things Medicare, choosing between Medicare Advantage and Medicare Supplements can be confusing. Both options offer different benefits, costs, and coverage limitations. Neither option is a perfect fit for everyone because everyone has individual healthcare needs and budgets. This comprehensive guide will go over the pros and cons of each, helping you make an informed decision that best fits your healthcare needs and financial situation.

What is the difference between Medicare Advantage and Medicare Supplements?

Medicare Advantage (Part C)

Medicare advantage, also known as Part C, is an alternative to Original Medicare (Parts A and B) provided by private insurance companies. These plans combine your Part A, Part B and usually Part D prescriptions into one managed plan. Most Medicare Advantage plans also provide additional benefits like dental, vision, hearing, over-the-counter, and fitness memberships. Unlike Original Medicare, these plans have a maximum out-of-pocket cap on how much you spend each year. This means you may have lower out-of-pocket costs on a Medicare Advantage plan versus Original Medicare.

Medicare Advantage Myth: Medicare Advantage won’t cover what Medicare does.

FACT: All Medicare Advantage plans have been approved by CMS to cover AT LEAST what Original Medicare covers. Most plans actually cover more than Original Medicare.

Learn the 5 Common Misconceptions About Medicare Advantage: Debunking the Myths before deciding between plans.

Medicare Supplements (Medigap)

Medicare Supplements are policies offered by private insurance companies to cover gaps in Original Medicare coverage. These are plans you can buy to help pay your share of out-of-pocket Medicare costs. This includes deductibles, copayments, and coinsurance. Medicare Supplements goes on top of your Original Medicare, so you must have both Part A and Part B to enroll in one. Because these plans do not include Part D prescription drug coverage, you must enroll in a separate Part D plan.

Want more help navigating Medicare?

don’t do it alone! We are here to make it easier!

What are the pros and cons of Medicare Advantage and Medicare Supplements?

Pros and Cons of Medicare Advantage

Medicare Advantage Pros:

- All-in-One Coverage: Most Medicare Advantage plans include Part D (prescription drug coverage) and additional benefits like dental, vision, and hearing care, offering a comprehensive package. This means one insurance card at all doctors and pharmacies.

- Cost-Effectiveness: Medicare Advantage plans often have low or $0 premiums compared to Medicare Supplements. They also have lower copays and deductibles than Original Medicare.

- Out-of-Pocket Limits: There’s a cap on out-of-pocket expenses, providing financial protection against unexpected healthcare costs. Original Medicare has no out-of-pocket cap so anything catastrophic could continue to rack up ongoing medical costs.

Medicare Advantage Cons:

- Provider Restrictions: You’re typically limited to the plan’s network of healthcare providers. However, there are many PPO plans that allow you to go out of network but with a higher cost share.

- Area-Based Availability: Plans and benefits vary by region, and not all plans are available in every area. If you move out of the plan area, you may need to make a change. Also, if you travel and spend many months in another state it may be hard to find network providers. Emergency is always covered without a network in the U.S.

- Annual Changes: You are limited to certain enrollment periods on when you can make a plan change. If you do not qualify for a Special Election Period then you must wait until the Annual Election Period to add, drop, or change your plan.

- Pre-Authorization: Like employer or group plans, Medicare Advantage plans are managed plans and may require pre-authorization for some services. But Original Medicare also has some pre-authorization requirements even when you have a Medicare Supplement.

Pros and Cons of Medicare Supplements

Medicare Supplement Pros:

- Flexibility: You can see any doctor that accepts Medicare, offering more freedom in choosing healthcare providers.

- Nationwide Coverage: Unlike Medicare Advantage, Medigap policies provide coverage across the U.S. without a network, and some even offer emergency healthcare coverage abroad. This is important for Snowbirds who spend half the year in different states.

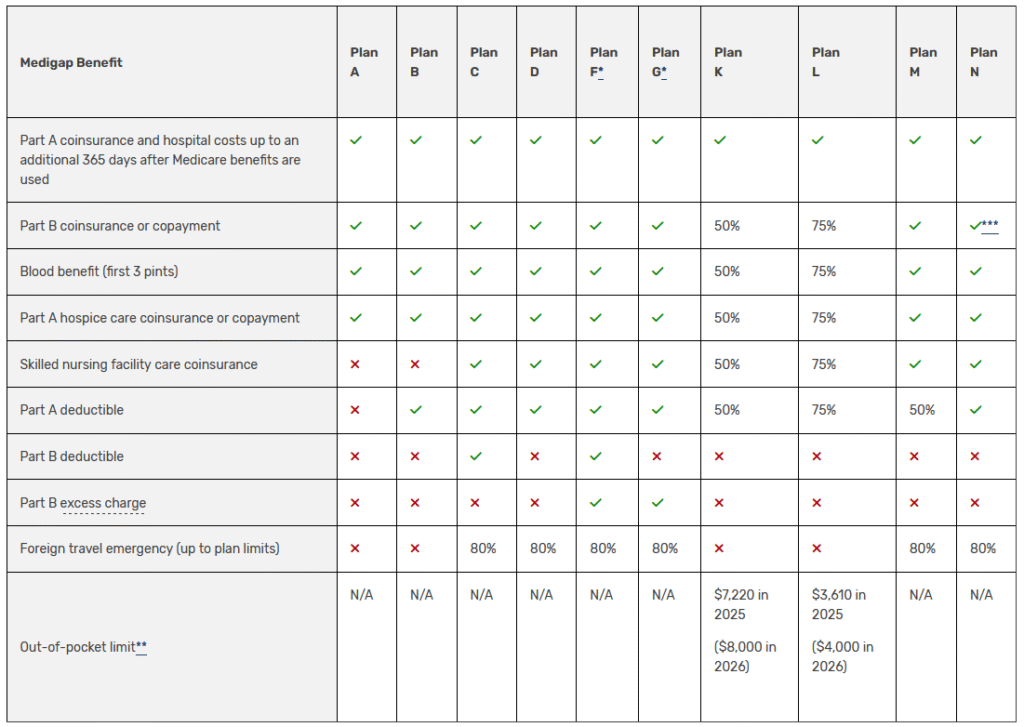

- Standardized Plans: Since Medicare Supplement plans are regulated, it is easy to compare plans across companies. Each company has to offer the same coverage for the same plan. For example, Plan G at Company A has the exact same coverage as Plan G at Company B.

Medicare Supplement Cons:

- Higher Premiums: Medigap plans usually have higher monthly premiums compared to Medicare Advantage. Premiums can continue to rise and get more expensive each year as you get older. However, there are some lower premium options with less coverage.

- No Drug Coverage: Medicare Supplement plans do not include prescription drug coverage. Since Medicare recipients are required to maintain drug coverage, they will have to enroll in a separate Part D plan to avoid penalties.

- No Extra Benefits: These plans do not include extra coverage like dental, vision, or hearing, which are often included in Medicare Advantage plans. You will need to buy separate plans to get coverage.

- Medical Underwriting: In most states, after your initial enrollment period, you may be subject to medical underwriting if you want to switch plans or enroll in a plan. So enrollment is not always guaranteed. Depending on your health, you could be rated up with a higher premium or denied coverage altogether.

Making Your Medicare Coverage Choice

Choosing between Medicare Advantage and Medicare Supplements depends on your personal health needs, budget, and preferences. If you prioritize flexibility and don’t want to worry about out-of-pocket costs, Medigap might be your choice. However, if you prefer an all-in-one plan with additional benefits at potentially lower monthly costs, Medicare Advantage could be more appealing.

You should assess your healthcare needs, consider your budget, and compare plans before deciding on a plan. Consulting an independent agent can provide you personalized, unbiased assistance. They can help you compare all plans across carriers in your area. If you plan to travel outside of the U.S., then compare how plans do or don’t cover you for emergency medical as well. Either plan option is limited when traveling abroad, so learn more about Medicare and Travel Insurance: Why You Need Emergency Medical Coverage Outside of the Country

Explore more on the Benefits of Using an Independent Agent for Medicare in our previous blog.

Remember, the best choice varies from person to person. By considering the pros and cons of each option, you can select a plan that best suits your healthcare needs and financial situation.

Still have questions about the Medicare or want to compare plans in your area? Feel free to reach out to our licensed agents. We help make Medicare simple. Contact us here.