Thanks to the Inflation Reduction Act, the maximum out of pocket amount that beneficiaries will spend on prescriptions drugs will be drastically lower than previous years. Starting in 2025, all Medicare plans will include a $2,000 Part D maximum out-of-pocket (cap) for prescription drugs covered by the plan. If your out-of-pocket spending on covered drugs reaches $2,000 for the calendar year, then you will enter the Catastrophic Stage. During this stage, you pay nothing for your covered Part D drugs for the rest of the year. But what most people don’t realize is that this $2,000 cap does not always mean $2,000 out-of-pocket for beneficiaries.

In this blog we will discuss the $2,000 Part D cap calculation and why your out-of-pocket maximum may be less. It is not as straight forward as many people would think.The calculations for the new $2,000 cap are complicated. Unfortunately, you will not be able to calculate it on your own, but it is helpful to understand how it is calculated. This way, if you reach your $2,000 before the year is up you will know “others” are paying on your behalf. Our licensed agents have technology that completes the Enhanced Plan calculations to help you compare plans in your area.1

What IS NOT included in the $2,000 Part D cap?

First off, we want to make sure everyone understands what is NOT included in the $2,000 Part D maximum out-of-pocket. The monthly Part D plan premium does not count toward the $2,000 maximum out-of-pocket. It doesn’t matter if you get your coverage through a stand-alone Part D plan or a Medicare Advantage plan with Part D coverage, the premium is excluded from the cap.

The Part D cap only includes amounts for prescriptions covered by your plan. This means that if you pay out-of-pocket for a drug that your plan does not cover, then this amount does not count toward your $2,000 cap. This is also true for over-the-counter medications like cold and flu, headache, and allergy medicine. Not only must the drug be covered by the formulary, but it must also be paid for under the plan. Sometimes we find discount coupons that are cheaper than the plan copay. This is a great way to save! However, we want to make sure you are aware that if you use the coupon to pay for the drug then the amount will not count toward your cap. Manufacturer coupons are treated the same way.

Does Medicare Cover Compound Drugs?

Also, the $2,000 cap is only for Part D drugs. There are many drugs that are covered under Part B instead of Part D. If you receive any of these Part B administered drugs, they will not count toward your cap.

What IS included in the $2,000 Part D maximum out-of-pocket?

Now that we know what does not count toward the $2,000 cap, let us look at what is included. How you reach the $2,000 cap is based on Medicare’s calculation of the True Out-of-Pocket cost. Also known as TrOOP. Since the TrOOP calculation is complex, you will not be able to calculate it yourself but it is helpful to understand what is counted in your TrOOP.

TrOOP includes the spending on covered Part D drugs made by the beneficiary or on their behalf by certain third parties. Some people will reach the $2,000 before they personally spend $2,000 due to payments made by third parties.

Payments made by the beneficiary

As mentioned, payments made by the beneficiary for drugs covered by the plan count toward the cap. This amount includes:

- Part D plan deductibles paid by the beneficiary before the plan kicks in.

- Copayments or coinsurance paid by the beneficiary during initial coverage period.

- Drug Costs on some approved formulary exceptions

Payments made by the Third Parties

The following payments made by third parties can reduce the out-of-pocket expense for beneficiaries. The below are counted toward the $2,000:

- Enhanced supplemental benefits offered by Part D plans

- Medicare’s Extra Help Program

- Qualified State Pharmacy Assistance Programs (SPAPs)

- Indian Health Service and certain other Native American organizations

- Supplemental commercial health insurance

- Legitimate charities

The most common third-party payments are from enhanced supplemental benefits offered by Part D plans. This is why some will meet their $2,000 without having spent $2,000. Part D plans can either offer Medicare’s defined standard Part D benefit (Basic Plan) or enhanced benefits (Enhanced Plan). Enhanced plans pay a higher percentage of some drug costs covered by the plan. This is an important distinction when calculating your max out-of-pocket. This is an important distinction because the amount the plan pays above the defined standard design counts toward your TrOOP. To understand which costs the Enhanced Plan pays toward your $2,000 cap, let’s look at the 2025 Part D standard benefit design.

What is the Part D standard Benefit Design?

Basic Part D plans use the standard benefit design. The standard benefit design for 2025 includes a $590 per year deductible, 25% cost share for medications, and then $0 for drugs after $2,000. This means the $590 deductible and 25% of drug costs during the Initial Coverage stage count toward the $2,000 maximum out-of-pocket.

Note about Part D covered vaccines: Since Part D covers ACIP-recommended vaccines at zero dollar cost-share, they do not contribute to the $2,000.

How is my $2,000 Part D maximum out-of-pocket calculated with a Basic Part D plan?

If you have a Basic Plan, then your $2,000 Part D maximum out-of-pocket is based on what you actually pay out of pocket at the pharmacy based on your plan’s coverage. This is because the plan is using the standard plan design set by Medicare so only the amount you pay out of pocket will count towards the $2,000 cap.

| $2,000 Spending Cap for Basic Plan = What you ACTUALLY PAY out of your pocket based on your plan’s coverage |

How is my $2,000 Part D maximum out-of-pocket calculated with an Enhanced Part D plan?

Since Enhanced plans pay a higher percentage of drug costs than the Standard Benefit Design, the plan is contributing toward your $2,000 cap. This means you could reach your $2,000 cap before your actual out-of-pocket reaches $2,000. It also means a more complicated calculation for TrOOP. When enrolled in an Enhanced Part D plan, they calculate the cap differently from the basic plan.

| $2,000 spending cap = Greater amount of the 2 below |

| What you ACTUALLY PAY out of your pocket based on your plan’s coverage OR What you WOULD HAVE paid out of pocket under the 2025 Standard Prescription Drug plan. |

As you can see, the Enhanced Part D plan calculation is more complicated. Here is an example to help you understand how the calculations work in this scenario.

Enhanced Drug Plan Example:

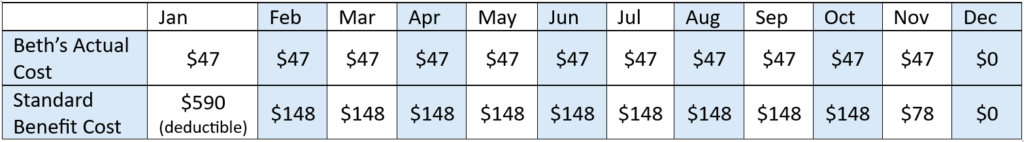

Beth is enrolled in a Medicare Advantage plan with a Part D Enhanced plan. The plan has a $0 premium and $0 deductible for Tier 1, 2, and 3 drugs. She takes one expensive drug that costs $590 per month. Her plan formulary lists her drug as a tier 3 drug with a $47 copay.

On a Basic Part D plan, she would have paid a $590 deductible and 25% coinsurance. But since this is an enhanced plan, the plan is paying a higher portion of the drug and Beth is only paying the $47 copay. Remember, the $2,000 cap is based on the greater of either her actual out-of-pocket costs or what she would have paid on a Basic plan.

The cost on a Basic plan would reach $2,000 by November. But her actual costs are only $47 x 11 = $517 as shown below. This means she is reaching the Catastrophic Stage and will pay $0 even though her out of pocket cost did not reach $2,000.

This scenario is simplified for example purpose and many real-world scenarios may not be this low for actual out-of-pocket expenses. It is only used as an example to clarify why some beneficiaries can reach the Catastrophic Stage before they spend $2,000.

How is my $2,000 cap calculated with Medicare Extra Help?

If you receive Extra Help, the amount that Extra Help pays to reduce your deductible and copays will count toward the $2,000. This means you could reach Catastrophic Stage earlier in the year if you have a lot of expensive drugs. Learn more about Extra Help and see if you qualify, visit our blog What is Extra Help and how can it help you save on prescriptions?

Looking for other ways to save on Medicare expenses? See our Resources to Help with Medicare Expenses page.

Conclusion

The calculations for the new $2,000 cap are complicated. Unfortunately, you will not be able to calculate it on your own, but it is helpful to understand how it is calculated. This way, if you reach your $2,000 before the year is up you will know “others” are paying on your behalf. Our licensed agents have technology that completes the Enhanced Plan calculations to help you compare plans in your area. Reach out to one of our local agents today!

- Part D drug information from https://www.medicare.gov/drug-coverage-part-d/costs-for-medicare-drug-coverage/catastrophic-coverage ↩︎

Would not the added premium cost of the Part D enhanced drug plan, if any, offset the accelerated savings in reaching the $2000 cap earlier? If so, why not indicate that in the discussion.

Hi Zeb…. It will depend on your specific prescriptions, but yes, many on enhanced drug plans offset expensive drugs even though they have a higher premium costs but not all. This is when they take a lot of different expensive/mid priced drugs. Plan formularies are set up different across plans and don’t always cover the same prescriptions at the same tier. So a higher premium may not be the better option if a lower cost plan has your specific drug at a lower tier. We always run prescriptions on our platform that compares all costs across plans to determine who has the lowest overall yearly costs. But it is a good point to bring into the discussion! Sometimes even the most expensive plan in an area can be the more affordable option when looking at total yearly cost. We just want to make sure people understand it isn’t always the case. The fun of Medicare…. it really depends on the person and their prescriptions.

Trump ruined it!

You mean Obamacare?

I got better benefits under Medicare for almost nothing compared to when I was working and paying for healthcare

These decisions were made Before he was in office….seriously!

Where can we see where we are at in meeting the 2,000?

Hi Marita… Your insurance carrier would have that information. You should be able to log in to your carrier portal and see how much you have towards the cap, but if not you can call the number on the back of your insurance card to get the amounts.

so if my part of pmt is 2000.00 for my meds and i pay that will medicare pay for the medicine for the remainer of the year?

correct, once your out of pocket at the pharmacy reaches $2,000 then your prescriptions covered by your plan will be $0 at the pharmacy. You will still have to continue to pay your monthly premium though. And the $2,000 starts back over each year.

per person or per couple?

Hi Jeffrey, $2,000 is per person. So it is an individual max out of pocket.

Do I need a Part D Plan to obtain the benefit of the $ 2,000 catastrophic coverage?

Great question. You will need either a stand alone Medicare Part D drug plan or a Medicare Advantage Plan that includes drug coverage. Either policy will give you the benefit of the the $2,000 maximum out of pocket drug cost for drugs that are included on that plan’s formulary.

My new Aetna medicare plan has me paying about 3,100 (258/mo) with a 450.00 dedictoble for ONE medication. (Quelipta for migraines) Would I be eligible for this 2G cap? Is there someone we can go to that can calculate and tell us how it works.

Hi Lynne! If your prescriptions are more than the $2,000 right now, then it may be because one of your prescriptions are not covered on your plan’s formulary. Is it a Medicare Advantage plan? If you call our office we can help you determine this and see which plans cover all of your prescriptions to keep you within the cap. Our system will show a breakdown of costs by month and by prescription for all plans in your area. Call our office at 480-821-9188 and let us know you were from the chat. One other thing to note is that if your drug is on the formulary, then it may just be very expensive in the beginning of the year and then once you reach your cap you would pay $0 at the pharmacy. I am not sure the exact plan you have, but you can always call and we can help confirm. Medicare has a new prescription payment plan that lets you smooth out the costs when you have expensive prescriptions that costs more in the beginning of the year due to deductibles and copays. This could very well be the case for you.

I’m supposed to start an injection medication at home in place of getting infusions at the hospital. I will have met the 2,000$ after I pay my part of 33% of the medication which is $506. It is a tier 5 medication Will it be completely covered every month after I reach 2,000$ ? Or will it cost me the 506$ every month? Thankd

Once you hit your $2,000 max out of pocket it will be covered at 100%. Double check with your plan on the cost of the drug though. It sounds like your calculation could be off, but it depends on if your plan is an enhanced plan or not. If it is a tier 5 drug then it may have a deductible. Unless you have a plan without a deductible? We can look it up for you to see exactly how much you will pay out of pocket on your plan if you want to call the office. Our system will give a month by month breakdown of your actually out of pocket costs. 480-821-9188

I take jardiance for chronic kidney disease stage 3B. My part d plan charges $900 for the first quarter which they call the deductible phase and then they pick up a good share of the charge for the second and third quarter. What I found out last year was that when I reached the fourth quarter I was in what they call a donut hole and I had to pay the full amount again. Since I could not afford to do that, I did not get the prescription refilled for the fourth quarter. So I went for 3 months without jardiance and then picked it up again in January. Since I could not afford to do that, I did not get the prescription refilled for the 4th quarter. So I went for 3 months without jardiance and then picked it up again in January. Is that a reasonable way to handle The situation. My SS is only $1,700 a month.

Hi Beth. I highly recommend you call our office to discuss your situation. Where are you located? There are chronic special needs plans specifically for kidney disease in many areas, and different plans can cover jardiance at a lower cost. Also, based on your income you look like you could qualify for extra help paying for your prescriptions so that you do not have to go months without it. We specialize helping people in this situation. Please reach out at 480-821-9188. Let us know you were on the comments page asking this question!

I had to switch med advantage plans and am on a new plan as of today. I had paid $1875 in meds as of the end of March. Will this still go towards my $2000 cap or will it start over with the new company. The new company told me it starts again. I am a bit freaking out.

Hi Patti! Whoever you spoke with is incorrect. Your Part D cap is a yearly amount set by Medicare, not the plan. Here is the direct verbiage from Medicare to help.

“Drug plans keep track of their enrollees’ TrOOP costs. When a person switches plans during the year, his or her TrOOP balance transfers to the new Medicare drug plan. Medicare has established processes for transferring the TrOOP balance. This transfer begins when someone disenrolls and then joins a new plan”

You can find a copy of the CMS document with this rule at this link. This way you have it for your records. https://www.cms.gov/files/document/11223-ppdf

Is a non formulary drug copay covered obtained with a prior authorization

Yes, if you have received a formulary exception from the Part D Drug plan company, then you will pay the co-pay for the specific tier of drug that the Part D plan has applied for the exception. This will typically be either a tier 3 or tier 4 co-pay. You will also have to pay any plan deductible if a deductible applies to that tier of drug on your specific plan.