High income earners may be subject to an Income Related Monthly Adjustment Amount (IRMAA) on both their Part B and Part D premiums. This means higher premiums for higher earners on a sliding scale. There are some strategies to help reduce or avoid IRMAA, depending on financial moves you make as you approach Medicare.

Continue reading to learn more about

What is IRMAA and who must pay it?

Income Related Adjustment Amount

Most people pay the standard Part B premium when they enroll in Medicare. But if you are a high-income earner, then Medicare will adjust your premium higher depending on how much income you make. This is amount is known as IRMAA (Income Related Monthly Adjustment Amount). IRMAA is an additional amount added to your Medicare Part B and Part D premiums if your income exceeds certain thresholds. The more you earn, the higher your IRMAA.

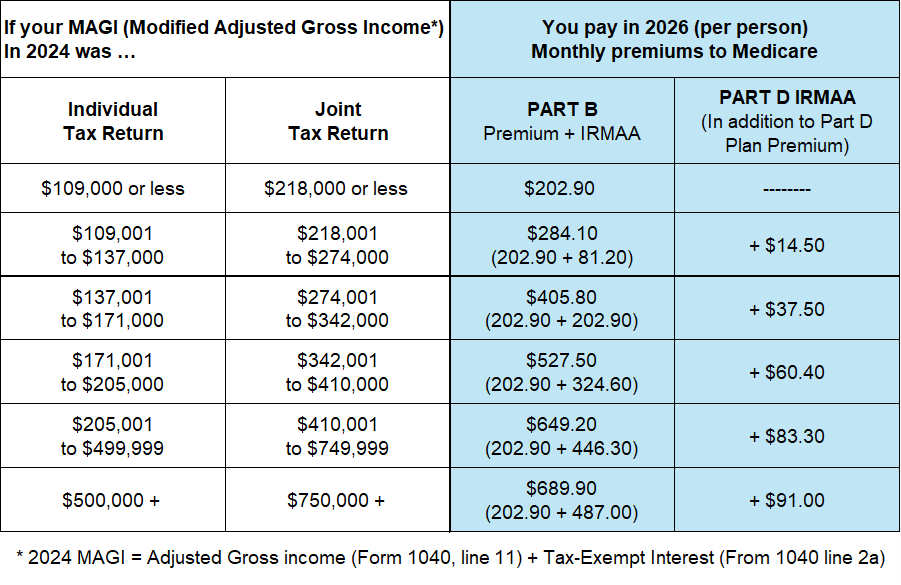

IRMAA Income Brackets

Each year Medicare releases income brackets that set the premium adjustments for both Part B and Part D. In 2026, if you make more than $109,000 filing individually or $218,000 filing jointly, then you will have a premium adjustment. IRMAA is based on your tax returns from 2 years prior to the current year. This is important to understand when making financial decisions leading up to Medicare.

How can you reduce your IRMAA for Part B and Part D?

The two methods for reducing your IRMAA is by lowering your Adjusted Gross Income through careful financial planning and by requesting an appeal through Medicare. Let’s take a closer look at both.

IRMAA Appeals

f you had a life-changing event and your IRMAA does not reflect your current income status, then you can request an appeal. As mentioned, IRMAA is based on your income from 2 years prior. Perhaps the income from 2 years ago was based on your employment income at the time, but you are no longer working. In certain circumstances like this, you can file an appeal to adjust your IRMAA. See our previous blog on how to file an appeal and which events qualify.

Want more help navigating Medicare?

don’t do it alone! We are here to make it easier!

Financial Strategies to Reduce Adjusted Gross Income (AGI)

As you approach Medicare eligibility, you should consider how different financial decisions can affect your adjusted gross income. Your salary might be below the income threshold for IRMAA, but certain major investment moves can increase your AGI. This is true even if they are a one-time event. We always advise that you speak with a financial advisor before making any financial decisions that will affect your ADI. We recommend this at least two years away from Medicare to avoid making the wrong moves.

With that said, here are some common strategies we see for reducing AGI.

- Max out your 401(k): If you are still employed, maxing out your 401k or IRA can reduce your adjusted gross income.

- Converting Traditional IRA to Roth IRA

- Delay making withdrawals from your tax-deferred retirement accounts

- Delay taking Social Security

- Make Qualified Charitable Distributions

- Contribute to an HSA

- Consider the timing of Stock sales prior to the 2 years when you’ll receive Medicare.

- Time the sale of a home or investment property to not affect IRMAA

These are some popular strategies we see people utilize to help reduce their income and amount of IRMAA. This information is not intended to replace the advice of your financial advisor! It is intended to get you thinking about what IRMAA early on, and how your income can affect your Part B and Part D premium. We want to stress the importance of speaking with a financial advisor so you can be fully prepared when you start Medicare.

What can we help with? We can help you determine your IRMAA amount based on the current year, we can help you compare plans, enroll in Medicare, and answer all of your Medicare specific questions.

Please reach out to speak with one of our friendly agents! We love to help!