This blog has been updated on 12/18/2025 to reflect the new changes to Original Medicare new pre-authorization testing in 6 states.

Most people who have had health insurance are familiar with pre-authorization requirements for medical services or prescription drugs. This practice has been widely implemented across the insurance industry. Traditionally, Original Medicare (Part A and Part B) did not require prior authorization for most medical services. However, over recent years Medicare has adopted some pre-authorization requirements for certain services and equipment. As a beneficiary deciding on your Medicare coverage, it is important to understand when Medicare requires pre-authorization and how this can affect your decisions on Medigap and Medicare Advantage coverage options.

Understanding Medical Pre-Authorization

Medical insurance pre-authorization, also known as prior authorization, is a process where a healthcare provider or patient must obtain approval from the insurance company before a specific service, procedure, or medication is provided. It’s their way of saying, “Yes, it is medically necessary and will be covered” prior to getting the treatment or procedure. Typically, pre-authorization is required for things like specialized treatments, advanced imaging, surgeries, or expensive medications. Medical necessity is key in the pre-authorization process. Insurance companies use pre-authorization to ensure care is needed and to prevent fraud and abuse.

When Does Medicare Require Pre-Authorization?

As mentioned, Medicare did not previously require pre-authorization. But this changed in recent years as the Center for Medicare and Medicaid Services’ (CMS) assessed services that are vulnerable to fraud, waste, and abuse. CMS has implemented various pre-authorization requirements over the years to help reduce these vulnerabilities and ensure proper Medicare billing before services are rendered. They previously added many more pre-authorization additions between 2020 and 2023.

In 2026, Medicare will begin new prior authorization tests on more medical services that are typically vulnerable to overuse or improper billing. The test case will be limited to 6 states at first: Arizona, New Jersey, Ohio, Oklahoma, Texas, Washington.

Medicare’s list of services and equipment that require pre-authorization include:

- Prior Authorization for Certain Hospital Outpatient Department Services

- Prior Authorization for Repetitive, Scheduled Non-Emergent Ambulance Transport

- Prior Authorization Process for Certain Durable Medical Equipment, Prosthetics, Orthotics, and Supplies

- 2026 test case will target procedures like nerve stimulators (spinal, vagus, deep brain), epidural steroid injections, cervical fusion, arthroscopic knew procedures, certain skin/tissue substitutes, diagnosis and treatment of Impotence

Your doctor will know when a pre-authorization is required, and they will facilitate by submitting the request to Medicare.

An important note about Medicare Supplements: If you have a Medicare Supplement and Original Medicare denies a pre-authorization, then your supplement will not pay either.

How does Medicare Pre-authorization differ if you have a Medicare Advantage plan?

There are many misconceptions that Medicare Advantage coverage is not as good as Original Medicare. Medicare Advantage, also known as Part C, is a part of Medicare and MUST cover at least all the same services as Original Medicare. However, Medicare Advantage organizations are allowed to impose additional administration requirements before the services are provided. What does this mean? This means that some carriers can require pre-authorization to determine “medically necessary” beyond those required by Original Medicare. They also do this to help prevent fraud, waste, and abuse in other service areas. This does not mean they can deny a legitimate claim that is deemed medically necessary and covered by Medicare.

Differences between Medicare Advantage Carrier pre-authorization requirements

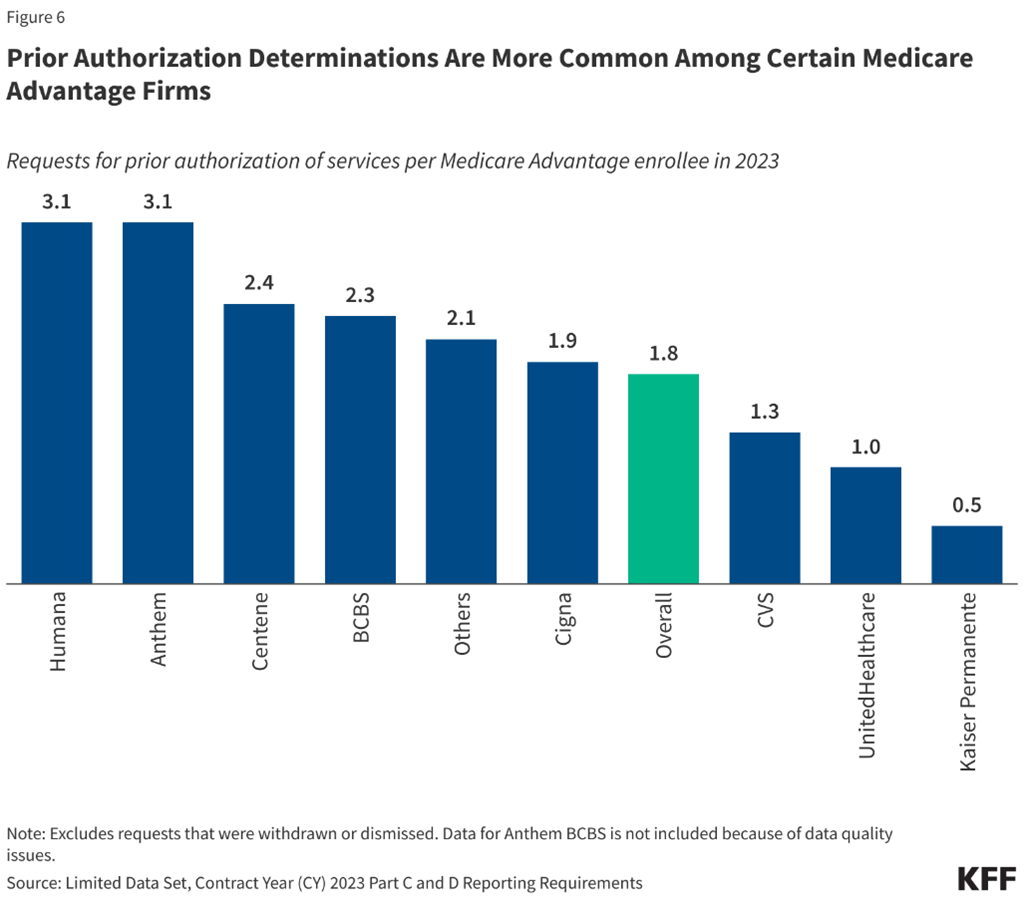

Every carrier does not always require as many pre-authorization for services. Per KFF data for MAPD Pre-authorization request3, the number of pre-authorization requests 2023 varied by carriers and ranged from .5 to 3.1 per person per year. But across most insurers, a higher number of prior authorization determinations per enrollee was correlated with a smaller share of requests being denied and vice versa. So those that required more pre-authorizations typically had a lower percentage of denied claims.

Medicare Advantage denial rates also vary across carriers, ranging from 3.5% to 13.6% denials. However, as mentioned earlier the higher denials are typically based on lower number of pre-authorization requests. Therefore, denial percentage does not necessarily equate to a higher number of claims denied. Across the board for 2023, 6.4% of MAPD pre-authorization claims were denied. But of those claims that were appealed, over 80% were overturned. The problem is that only 11.7% of people filed an appeal. With the high rate of appeals being overturned, you should always appeal!

The difference between initial denial rates and overturned claim success could be attributed to the “use of artificial intelligence (AI) and algorithmic software to guide coverage decisions” for pre-authorization requests.3 This is a good reason why you should always appeal your pre-authorization request if it gets denied and you believe it is medically necessary. But the good news… At the end of 2024, CMS proposed new AI limits and guardrails to address some of these issues.4 This could help reduce the number of denied pre-authorizations.

Does Medicare Part D require pre-authorizations?

Medicare Part D plans are always administered by private insurance carriers, so most plans do have pre-authorization requirements for some drugs. They may require pre-authorization for a drug to verify it is medically necessary or when it is only used for certain conditions. This varies by carrier and formulary structure and sometimes requires step therapy first.

How do I file an appeal for denied Medicare pre-authorizations?

If you disagree with a coverage or payment decision by Medicare or your Medicare Advantage carrier, you can file an appeal. Generally, there are 5 levels of appeals. If you disagree with the decision made at any level of the process, you can usually go to the next level. At each level you’ll get a decision letter with instructions on how to move to the next level of appeal.

The 5 levels to appeal a denied Medicare pre-authorization are:

- Level 1: Redetermination

- Level 2: Qualified Independent Contractor Reconsideration

- Level 3: Decision by the Office of Medicare Hearings and Appeals

- Level 4: Review by the Medicare Appeals Council

- Level 5: Judicial Review in Federal District Court

Make sure you pay attention to deadline dates so you don’t miss the dealing to appeal! It is best to get with your doctor to get any information that will make your appeal case stronger.

Original Medicare Appeals Process

The process for each level of the Original Medicare appeals can be found here.

Medicare Advantage Appeals Process

To appeal through your Medicare Advantage or Part D plan you will get an organization determination and follow the instructions to file a timely appeal. They must tell you, in writing, how to file an appeal.

Takeaways when deciding between Original Medicare and Medicare Advantage

The key takeaway when deciding on coverage options is that there are some pre-authorization requirements for both Original Medicare and Medicare Advantage. Medicare Advantage may require pre-authorization for more services, but this is not equal across carriers. Medicare Advantage plans must cover at least what Original Medicare covers, so if you have a legitimate medically necessary claim that gets denied then make sure you appeal! It is best to have a licensed agent help you find a carrier you like.

Learn about the differences between Medicare Advantage and Medicare Supplements in our blog, Medicare Advantage Versus Medicare Supplements: A Comprehensive Comparison.

Data sources:

- https://health.usnews.com/medicare/articles/medicare-require-prior-authorization?ABSwitch_varName=MedicareSponsor&ABSwitch_varValue=variation1

- https://www.aha.org/news/headline/2024-01-17-cms-finalizes-prior-authorization-rule-hospital-event-highlights-need-rule

- https://www.kff.org/medicare/issue-brief/nearly-50-million-prior-authorization-requests-were-sent-to-medicare-advantage-insurers-in-2023/

- https://datamatters.sidley.com/2024/12/19/cms-proposes-artificial-intelligence-limits-and-utilization-management-guardrails-for-medicare-advantage/

- https://www.kff.org/private-insurance/issue-brief/final-prior-authorization-rules-look-to-streamline-the-process-but-issues-remain/

- https://www.cms.gov/data-research/monitoring-programs/medicare-fee-service-compliance-programs/prior-authorization-and-pre-claim-review-initiatives

- https://www.cms.gov/files/document/pre-claim-review-program-statistics-document-fy-23.pdf