Welcome to the world of Medicare! Where the alphabet soup of healthcare promises confusion at every turn and leaves beneficiaries searching for answers. As you may be aware, there are 4 parts of Medicare, and each part covers different aspects of your healthcare coverage. As confusing as it can feel, it is necessary to get the basics down so you can take control of your healthcare and ensure you have appropriate coverage.

We are here to make Medicare simple and break down the four parts in an easy-to-understand way.

What is Medicare?

Medicare is a federal health insurance program for people aged 65 and older. It can also cover certain younger individuals with disabilities and those with End-Stage Renal Disease. Medicare coverage is divided into four different parts: A, B, C, and D. As mentioned, each part covers a different aspect of your healthcare and can work together to give you complete coverage.

Medicare Part A: Hospital Insurance

Part A is your hospital coverage. It is generally premium-free if you or your spouse have earned enough work credits to qualify.

What Part A Covers:

- Inpatient hospital stays

- Skilled nursing facility care

- Hospice care

- Home health care

What does Part A cost?

Most people qualify for premium-free Part A, but if you do not qualify for it premium free it can be purchased for up to $565 per month (in 2026). There are also deductibles and coinsurance associated with Part A. The inpatient stay deductible is $1,736 for each hospital benefit period. After you pay this deductible, you pay $0 coinsurance for days 0-60. After you reach 60 days, you will have a per day coinsurance. See the full list of Part A costs here.

If are low income and qualify for Medicaid then you could get assistance paying for your Part A premium. Learn more about How to Enroll in Premium Part A When You are Low Income and Qualify for Medicaid?

Medicare Part B: Medical Insurance

Part B is your medical coverage for outpatient services. It helps cover your regular healthcare services, such as doctor visits, labs, and x-rays. Together, Part A and B are known as Original Medicare and include the bulk of your healthcare coverage.

What Part B Covers:

- Doctor visits

- Outpatient care

- Preventive services (e.g., flu shots, screenings)

- Medical supplies (e.g., wheelchairs, walkers)

- Labs and tests

- Mental health

What Part B Costs:

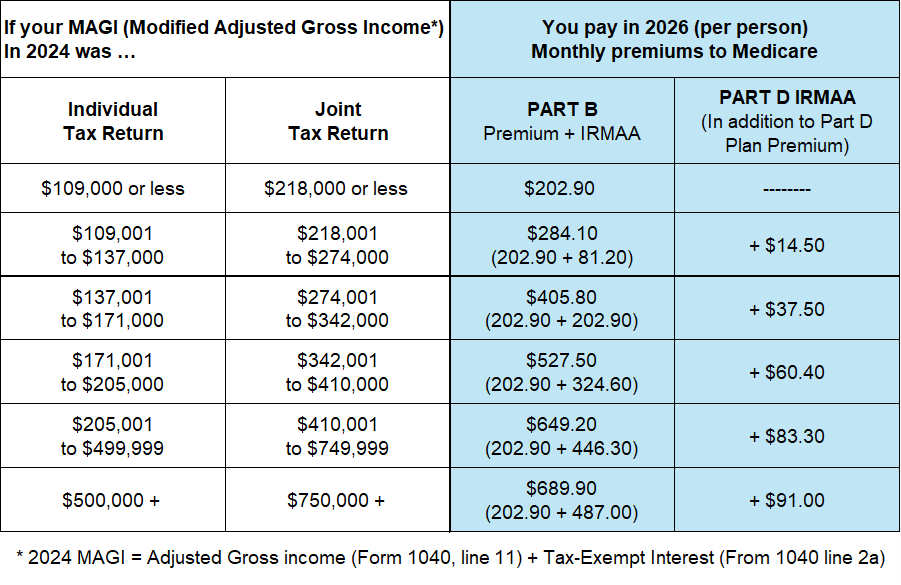

There is a monthly premium for Part B. Most people will pay $202.90 in 2026, but this amount can increase if you are a high-income earner. In 2026, you will pay a $283 deductible before insurance starts to pay. After you pay your deductible each year, you will pay 20% coinsurance on all Part B covered services and Medicare will pay 80%. There is no maximum-out-of-pocket to limit how much you can spend in a year. This means if you have $100k in Part B costs, then you would pay 20% of that without a cap.

IRMAA (Income-Related Monthly Adjustment Amount) Chart

Medicare Part D: Prescription Drug Coverage

Going out of alphabetic order, it is necessary to understand Part D before you learn about Part C. Part D is your prescription drug coverage and is offered by private insurance companies that are approved by Medicare. They are available in a stand-alone plan, or included in a Medicare Advantage plan. You must enroll in a prescription plan if you do not have creditable coverage or you could receive a lifetime penalty.

What Part D Covers:

- Prescription medications

- Some Vaccines

What Part D Costs:

Your prescription drug costs can vary depending on many factors. Each plan can have a monthly premium, deductible, and copays or coinsurance for prescriptions. According to NCOA, the average premium will be approximately $34.50 in 2026. However, there are plans that are less or more per month than this. Also, if you are a high-income earner then your monthly premium could be higher as shown in the graph above. The deductible and copays/coinsurance will vary depending on the plan and your prescriptions. Visit our blog on Prescription Plan Savings to see how to save and find the right plan.

In 2025, a few changes to Part D helped beneficiaries manage costs at the pharmacy. First, the Part D maximum out-of-pocket was capped at $2,000. This amount increased to $2,100 for 2026. After this, you will pay $0 at the pharmacy for prescriptions covered under your plan. Beneficiaries will also have the option to smooth out their pharmacy costs with the new Medicare Prescription Payment Plan (M3P).

Medicare Part C: Medicare Advantage

Part C is Medicare Advantage (MA). These are plans offered by private insurance companies that are contracted with Medicare. They are a part of Medicare! Medicare Advantage combines your Original Medicare (A & B) into one managed plan such as an HMO or PPO. Most MA plans usually includes prescription drug coverage. .

Learn 5 Common Misconceptions About Medicare Advantage: Debunking the Myths

Medicare Advantage plans must cover at least what Medicare covers. However, they usually include extra benefits that Medicare doesn’t offer.

What Part C Covers:

- All services covered by Part A Hospital and Part B Medical.

- Most include prescription drug coverage

- Often includes additional benefits like Dental, Vision, Hearing, Over-the-counter (OTC), or Part B giveback.

What Part C Costs:

Medicare Advantage (MA) plans often have low or $0 premiums depending on the plan and plan area. Other costs can include deductibles, copays, or coinsurance when you seek care or fill prescriptions. These costs are typically lower than Original Medicare and DO include a maximum-out-of-pocket cost. This maximum puts a limit on how much you can spend in any given year.

Conclusion

Understanding Part A, B, C and D is necessary for you to make informed healthcare decisions. Each part covers a different aspect of your healthcare services. We aim to give you confidence when making coverage decisions by giving you the tools and information you need. If you need more assistance, we can help! Meet our licensed agents and get in touch today.