Are you turning 65 and still working? Most people become eligible for Medicare at age 65 and generally need to enroll to get coverage and avoid penalties. But if you plan to continue working, then you have options to consider if you have creditable group coverage. If you are still working when you turn 65 then you will have to decide between Medicare and your employer group plan. This decision can affect more than just your healthcare costs and coverage. Here’s what you need to know when Choosing Between Medicare and your Employer Group Plan.

Things to Consider When Choosing Between Medicare and Your Employer Plan

1. Is my group plan considered creditable coverage?

The first thing you need to think about is whether your group coverage is creditable for Medicare Part B and Part D. If your coverage is considered creditable, then you have the option to delay both without penalties. If it is not creditable, then you could face penalties if you stay on your group plan and do not enroll in Medicare Part B or join a prescription drug plan.

Generally, your coverage is creditable if you can answer yes to all of the following:

- Your employer has 20 or more employees

- You or your spouse is actively working at the job with group coverage

- Your group coverage is creditable.

- Your prescription drug coverage is at least as good as Part D coverage.

You should receive notice from your employer each year that will let you know if your plan is creditable or not. Don’t assume that your coverage will continue to be creditable every year. If you meet all the above criteria, then you can delay part B and Part D. You would do this if you determined your group coverage is better or more affordable than Medicare. There may be an instance when your group coverage is creditable for Part B, but not for Part D. In this instance, you can delay Part B but may still need to get a Part D prescription drug plan in addition to your group plan.

2. Which coverage will cost me less, Medicare or my employer plan?

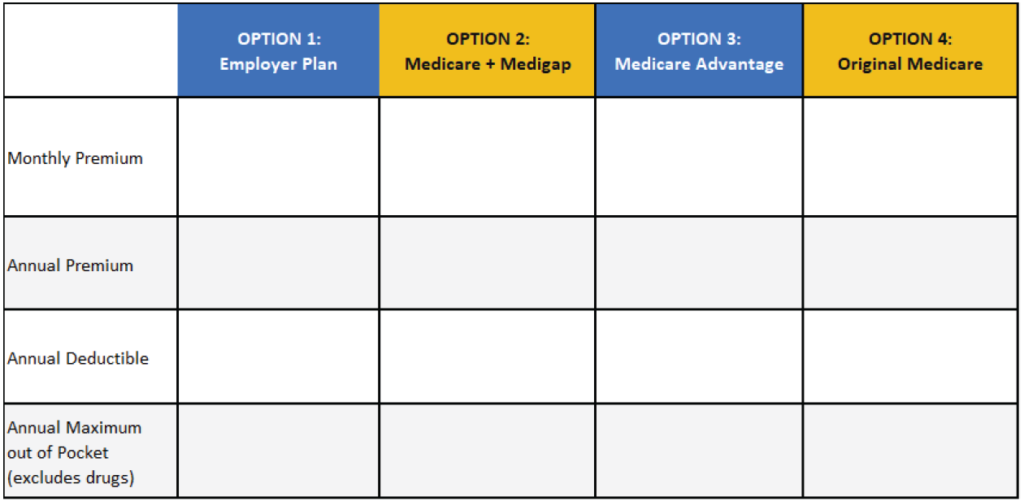

Cost will inevitably be a big factor when comparing Medicare to your group coverage. Costs can include premiums, deductibles, copays, and out-of-pocket maximums. Here are the main costs you need to consider and compare:

Monthly Premium Costs:

You should first compare monthly premiums to see how they compare. When considering Medicare premiums, it is important to consider Part B as well as available Medicare plan premiums. This is because the Medicare plan you choose may or may not have an additional premium associated with it. Medicare Supplements do have monthly premiums, and you generally must add a Part D plan with another premium. However, many Medicare Advantage plans do not have an additional premium, and they generally include Part D plans.

Deductibles/Coinsurance:

Check how much you must pay out-of-pocket before your insurance starts covering costs. Medicare does tend to have a lower deductible than many group plans, and many Medicare Advantage plans do not have a deductible. Copays and coinsurance is another expense. Think about what care and services you use most and see how copays differ between your group plan and Medicare.

Annual Maximum Out-of-pocket Cost:

Also consider catastrophic circumstances. If you have a catastrophic health event, how much could you pay out of pocket? Although Original Medicare (Part A & Part B) alone does not have a cap on how much you could spend in any given year, Medicare Advantage and Medicare Supplement plans do. These could be less than your employer plan.

Using a comparison guide to see costs side by side is a good idea. You can download our fillable estimation worksheet, Your Group Plan versus Medicare here.

3. Does your group health plan cover a spouse?

If your employer’s plan also covers a spouse who is not Medicare eligible yet, then your decision could affect their coverage. Most group plans will not continue to cover family members without the employee. If you leave your group plan before your spouse can join Medicare, they would need to find other insurance coverage. In this scenario, the decision still comes down to coverage and costs. Will you save more or spend more if you to join Medicare and find other insurance for your spouse?

4. Do you want to continue to contribute to a Health Savings Account (HSA)?

An HSA allows you to contribute pre-tax dollars that can be used to pay for qualified medical expenses. This helps reduce your tax liability and gives you savings for medical expenses. In order to contribute to an HSA, you must be enrolled in a High Deductible Health plan (HDHP). Since Medicare is not an HDHP, you must stop contributing to an HSA once you enroll. When deciding between Medicare and your group plan, you should consider if you want to continue HSA contributions or not. Read more about How Medicare Affects Health Savings Accounts to help you decide.

5. Will you have an Income Related Monthly Adjustment Amount added to your Part B premium?

When considering costs of Medicare versus your group plan, be sure you are using the correct Part B and Part D premiums. Most people pay the same amount for their Part B premium, but some people can pay more. If you are a high-income earner you could be subject to a premium adjustment. This is called Income-Related Monthly Adjustment Amount (IRMAA), and it applies to Medicare Part B and Part D. You should check the IRMAA brackets to see how much your Part B and Part D premiums could increase. This is important to make sure you are comparing accurate Medicare costs. If your premiums are in the highest brackets, this could make your Medicare less affordable than your group plan. A licensed agent can help you review the most recent IRMAA brackets and determine your adjustment.

Should I enroll in both Medicare and stay on my group plan?

Some people may consider enrolling in both when choosing between Medicare and Employer Group Plan. However, more is not always better. When you have creditable group coverage, then Medicare becomes the second payer and wouldn’t kick in until after your group plan pays. This can benefit you if you have Part A since it is premium free for most people, but not Part B. If you decide to stay on your group plan, then you can choose to enroll in Part A only. This means that Part A will help you reduce your hospital deductible costs in a catastrophic event. Keep in mind the implications it can have on your HSA if you are still contributing! Read more about Medicare and HSA contributions.

Part B does have a premium. You would be paying for two premiums if you enroll in Part B while on your group plan. This means increased costs. Also, enrolling in Part B while you still have creditable group coverage can have a negative effect on your Medicare plan options later. The timing of your Part B enrollment is important when it comes to joining a Medicare supplement. Your opportunity to join a Medicare Supplement without underwriting is 6 months from your Part B effective date. If you enroll in Part B while still working, then the clock starts ticking even if you have other creditable coverage. In this scenario, you may miss your opportunity to enroll into a Medicare Supplement without underwriting when you stop working.

Making an informed decision between Medicare and your employer group plan

There are many factors that can affect your decision when choosing between Medicare and your employer group plan. As you can see, it is not an easy decision. Aside from the above-mentioned factors, you also need to consider different Medicare coverage options available. You really need to compare all options and plans in your area before you can decide. Many large metropolitan areas can have a significant number of plans available! This can make it challenging to compare your options and feel confident that you’re making the best decision for your needs. Expert guidance from a licensed agent who specializes in Medicare is an important step. We always suggest you consult someone who is independent and contracted with all major carriers in your area. This will ensure unbiased advice and assistance.

If you have decided Medicare is a better option for you, visit our blog on How to Transition to Medicare from Employer-Based Insurance.